Victory in an administrative case: KORGAN defends the client’s interests in a dispute over alimony arrears

19.01.2025

The KORGAN law firm proudly announces its successful work in protecting the interests of a client in a complex administrative case on calculating arrears in alimony.

Background of the case

Our client, who is an individual entrepreneur, faced an unjustified calculation of arrears in alimony made by a private bailiff (PBI). The calculation was made without taking into account the entrepreneur’s obligations and expenses, such as:

- Employee salaries;

- Social and pension contributions;

- Taxes provided by law.

The CSI calculates the debt based solely on the turnover indicated in the tax return. However, this approach contradicts the norms of tax legislation, which require the responsibility of the entrepreneur when assessing his income.

Legislative basic calculation of alimony

The procedure for calculating alimony with income from debt is regulated taking into account the regulatory acts:

1. Law of the Republic of Kazakhstan No. 261-IV dated 02.04.2010 “Enforcement proceedings and the status of bailiffs” (Article 58), which establishes that deductions are calculated with the amount of income due to the debt received.

2. Order of the Minister of Justice No. 372 dated December 24, 2014, confirming the total income from which alimony is withheld. According to paragraph 11, alimony is withheld with income from entrepreneurial activity.

3. Administrative Procedure Code of the Republic of Kazakhstan (APC).

Features of calculating alimony for individual entrepreneurs

The procedure for calculating alimony from the salary and other income of the debtor is regulated by Law No. 261-IV of 02.04.2010 “On judicial proceedings and bailiffs”.

According to Art. 58 of this law, the amount of deductions is calculated from the amount of the debtor’s salary (income) due to him for receipt.

In accordance with the order of the Minister of Justice No. 372 of December 24, 2014, deductions for the maintenance of minor children are made from all types of wages (monetary remuneration, maintenance) and other income received by parents in monetary (national and (or) foreign currency), with the exception of the income of persons specified in indicator 2 of the specified list. In particular, this rule applies to income received from work in the entrepreneurial sphere without forming a legal entity.

For entrepreneurs using a special tax regime based on a simplified declaration (STR based on UD), the last line 910.00.001, reflected in form 910.00, represents the turnover from the sale of goods, works and services, which should not be considered as income of the individual entrepreneur for the calculation of alimony.

Income due to the individual entrepreneur to receive is formed only after filing tax returns and fulfilling obligations to pay salaries to employees, as well as paying all taxes and deductions for employees. The remaining net income is the actual income of the individual entrepreneur, which can be used at his own discretion.

Thus, the calculation of alimony in relation to an individual entrepreneur should be made exclusively from the amount of net income remaining after making and fulfilling all obligations for the reporting half-year. Accounting for the amount reflected in line 910.00.001 as total turnover, without appropriate adjustments to expenses, does not ensure the validity of the calculation of income for calculating alimony. Therefore, the calculation of alimony should be made from the amount of net income remaining after taxation for the reporting half-year.

Thus, when calculating alimony for entrepreneurs under the simplified system (SNR based on a simplified declaration), it is important to take into account that:

- Declaration form 910.00 indicates the total turnover for the sale of goods, works and services.

- Turnover is not the net income of the individual entrepreneur, since it also includes:

- Payment of wages to employees;

- Social and pension contributions;

- Tax deductions.

- Net income will only be obtained after all obligations have been fulfilled.

Errors in calculations and their consequences

In the case of an individual entrepreneur, the Private Judicial Enforcement Officer (PIO) determined the arrears in alimony and the final calculation was made on the basis of the total turnover indicated in the declaration form 910.00. However, this calculation did not take into account the individual entrepreneur’s expenses, which led to an overstatement of the alimony amount.

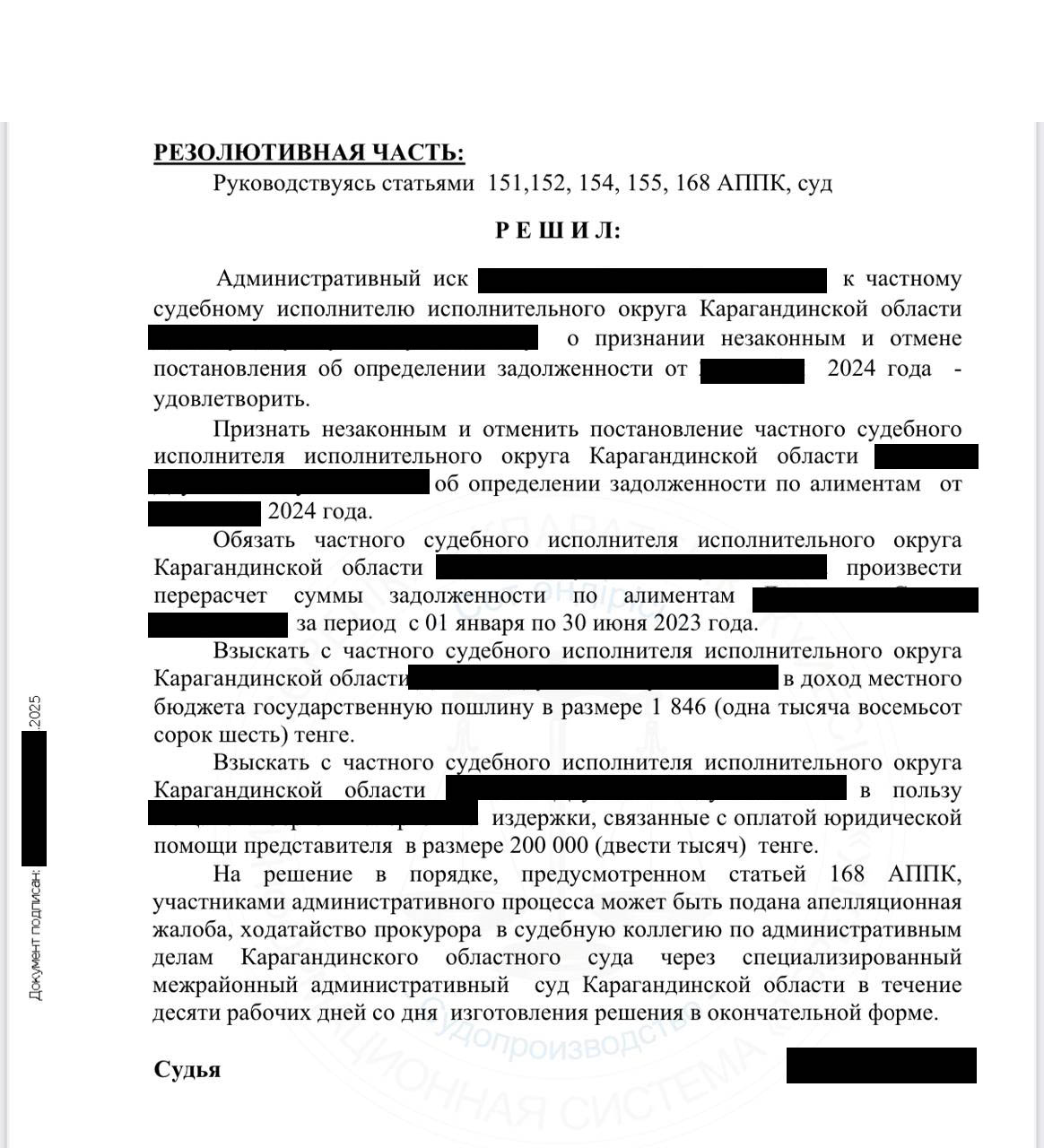

Court decision

The court found the ChSI ruling illegal, stating that the calculation was made without taking into account objectivity and reliability. The court ruled to cancel the ruling and obliged the ChSI to recalculate the debt taking into account the entrepreneur’s real net income.

Recommendations for entrepreneurs

- Provide complete and reliable data on your income and expenses: accounting documents, employment contracts, tax returns.

- Make sure that alimony is calculated based on net income, and not in total.

- In case of disputes with the provisions of the ChSI, contact professional lawyers to protect your interests.

The KORGAN law firm is ready to provide qualified assistance in such matters. We ensure fairness in calculations and protect your rights!

Contact our specialists by phone +7 700 50 00 553 or click on the “order a call” button below.

Author of the article: Berdysheva A.K.