In line for justice: state or arbitration court

In the realities of modern times, business acquires a “face”. It acquires a character, a mood, because business reflects our need for communication, recognition, popularity. We prefer a coffee shop where we know the barista or the owner himself, even from an Instagram page, we trust a doctor recommended by a friend, we buy goods in a well-known store.

But any partnership agreements, like acquaintances, can be with a minus sign: either you made a mistake and let us down, or your business partner did. What to do if pre-trial negotiations have reached a dead end, and the parties do not see any way to reconcile? The final step in the search for justice is the court. And here the most interesting part begins.

In Kazakhstan, for more than 20 years, there has been an alternative practice for judicial dispute resolution – through the state judicial system and in arbitration court.

With the state court, everything is more or less clear. Step by step: claim, evidence, state duty, consideration, court decision with the right to appeal. Minor variations of this path are set out in the country’s specialized codes and there is no need to retell them.

Let’s look at the arbitration court. Let’s start with the theory: in Kazakhstan, the work of arbitration courts is regulated by the Law “On Arbitration” dated 08.04.2016, which replaced two laws: the Law of the Republic of Kazakhstan “On Arbitration Courts” dated 28.12.2004 and the Law of the Republic of Kazakhstan “On International Commercial Arbitration” dated 28.12.2004.

There are two popular questions about the arbitration court: what is it and how does it work. The arbitration court is not a state court. It exists in the forms of permanent or temporary arbitration. The list of permanent arbitration courts is on the websites of the Ministry of Justice of the Republic of Kazakhstan and the Arbitration Chamber of Kazakhstan. Temporary arbitration is created to resolve a specific dispute. The court may include one or several arbitrators, who are elected by the parties to the dispute themselves. The arbitrator must meet the requirements of the Law “On Arbitration”. If the parties have applied to permanent arbitration, the dispute will be considered according to its rules; if the arbitration is temporary, the parties themselves determine the procedure for consideration. The procedure is approximately the same as in a state court: claim, evidence, response to the claim, consideration and decision on the merits. What to do with an arbitration decision? The same as with a state judicial act: you can appeal, you can issue an enforcement document.

Of course, it is impossible to tell about all the nuances within a short article, but there is good news, even two.

First: there is room for a couple of practical tips. To apply to arbitration, there must be an agreement or a condition in the contract on the jurisdiction of the arbitration court between the parties. Appealing to arbitration is paid, the cost is determined by each arbitration independently, and such payment can be much more expensive than the usual state fee. Before applying to arbitration, check its validity through the websites of the Ministry of Justice and the Arbitration Chamber of Kazakhstan. The competence of arbitration is limited by types of disputes.

Second: if everything is still unclear, but very interesting, or the business partner insists on an arbitration clause in the contract, contact us for advice. We will help, explain, protect.

In general, if we compare very broadly, state and arbitration courts are like state and private clinics. The choice is, of course, yours, but health requires a responsible attitude.

Confidence with KORGAN

Protection with KORGAN

Explanations for construction and installation works 3 Categories

Main Courts

Three Important Points When Filing a Claim

KORGAN successfully registered two companies in the AIFC

KORGAN Law Firm has successfully completed the registration of two companies in the Astana International Financial Center (AIFC). The work was carried out under the supervision of lawyer Aigerim Erikovna Kalibekova, who provided fast and professional support to clients at all stages.

Registration in the AIFC provides businesses with international opportunities, a preferential tax regime and protection of rights in an independent court.

If you are planning to open a business in the AIFC, entrust it to experienced specialists.

📞 Contact us:

Phone: +7 700 5000 553

Email: korgan.kaz@gmail.com

KORGAN is your legal partner in the AIFC.

Company registration in the AIFC: advantages, forms and legal support

Starting a business in Kazakhstan is becoming more and more international thanks to the Astana International Financial Centre (AIFC). This is a unique platform that allows you to operate under English law, attract foreign investors and use international business standards.

If you are planning to register a company in the AIFC, it is important to understand the legal structure, requirements and benefits that this financial centre provides.

Why choose the AIFC for business registration?

- International business standards

- Independent judicial system (AIFC Court, International Arbitration Centre and Mediation Centre)

- Transparent regulation and strict control of AFSA

- Preferential tax regime

- Reliable protection of the rights of investors and companies

Legal forms of companies in the AIFC

Companies can be registered in the AIFC in the following forms:

- Private Company – optimal for small and medium-sized businesses

- Public Company – to raise capital through an IPO

- Investment Company – for investment projects

- Restricted Scope Company – for a limited type of activity

- Special Purpose Company – for specific tasks

- General Partnership – with full liability of partners

- Limited Partnership / LLP – flexible forms with limited liability

- Non-Profit Organisation / Funds – for non-profit activities

- Accredited Companies – companies with an AIFC license

Conditions for registering a company in the AIFC

- Absence of inactive companies or debts of the founders

- Registration is possible only in the city of Astana

- Compliance with the AIFC Act on Companies

- Maintaining tax records and reporting in RK

- Dispute resolution – only within the civil law sphere

Advantages of working in the AIFC jurisdiction

- Access to international investments

- Participation in forums and business communities

- Efficient dispute resolution mechanisms

- Minimization of legal and financial risks

Why you should contact the KORGAN law firm

Correct registration, choice of company form and legal support in the AIFC require knowledge of legislation, international law and experience in doing business with foreign partners.

KORGAN Company offers:

- Consultations on registration and choice of company form in the AIFC

- Preparation of documents in English and Russian

- Full support at all stages of registration

- Support in reporting and compliance with AFSA requirements

- Protection of interests in the AIFC Court and International Arbitration

📞 Contact us today:

KORGAN Law Firm

Phone: +7 700 5000 553

Email: korgan.kaz@gmail.com

KORGAN — your partner in the AIFC jurisdiction.

«KORGAN» protected clients from losses of 50+ million tenge: how to invalidate a transaction

The team of the law firm “KORGAN” successfully challenged three major transactions, saved clients from losses of over 50 million tenge and proved that even the most complex contracts can be declared invalid. Find out how we achieved this and how we can help you!

Clients fell into a trap: unfair schemes on social networks

Entrepreneurs contacted us who became victims of aggressive marketing on social networks. They were offered a “unique patented method of hair restoration” that guaranteed a high income. In fact:

- No profit – the promises turned out to be empty

- Lack of support – after the clients paid, they were abandoned

- Useless patent – the method had no commercial value

Clients signed contracts with monthly payments of up to 300,000 tenge for years to come. When they tried to terminate the agreement, they were intimidated with fines.

How KORGAN cancelled contracts and saved clients

The case was handled by intellectual property lawyer Emin Shirinov. Our strategy:

-

1. Contract analysis – revealed violations and manipulations

- Clients avoided paying 15-20 million tenge each

- All patent holder claims rejected

- Obligations cancelled – clients free from unfair conditions

- Specialization: complex disputes over contracts and intellectual property

- Experience: victories in cases with multimillion-dollar risks

- Free consultation: we will assess your situation before filing a claim

- Power of attorney from a non-resident legal entity to our employees

- Notarized copy of the passport of the head of a non-resident legal entity

- Constituent documents (Charter, certificate of state registration, certificate of tax registration, order (decision/minutes) on the appointment of the first director)

- Extract from the Trade Register

- Power of attorney according to the NUC RK sample

- BIN

- IIN for the company manager

- Seal for a foreign company, in which the Kazakhstan BIN will be indicated

- Application of the NUC RK

- Received IIN for the company director

- Received BIN

- Issued an EDS for an authorized person

- Received the opportunity to participate in a tender in Kazakhstan

- Experience working with foreign government agencies. We understand the specifics and bureaucratic features of such companies.

- Deep knowledge of Kazakhstani legislation. All actions were in compliance with regulatory requirements.

- We work in a short time. We know how to negotiate, we know with whom and how to interact.

- Full transparency and support. The client is always aware of the current status and the next step.

- International approach. We work with both private companies and government organizations abroad.

- For example, your constituent documents will be among the first to be requested by the bank, since their provision is an important condition for opening a company account, as well as for subsequent changes made to the constituent documents.

- Constituent documents play a key role when participating in tenders. They provide information on the legal status, goals and objectives of the company, which allows procurement organizers to evaluate potential suppliers.

- When selling a share in a limited liability partnership (LLP), constituent documents, such as the charter and the memorandum of association, regulate the procedure for alienation of the share. They contain information on the rights and obligations of the participants, as well as on the procedures related to the sale or transfer of the share. In such situations, it is important to have clearly drawn up and legally correct documents.

- Constituent documents can also be used when challenging transactions or decisions made by a legal entity. They establish rules and procedures that must be followed in the company’s activities, and may be the basis for recognizing a transaction or decision as invalid if they are violated.

- Publication in a legal newspaper

- Constituent documents

- Charter

- Document confirming payment to the State Corporation “Government for Citizens” for deregistration of a branch (representative office) of a legal entity that is a commercial organization

- Liquidation balance

- Certificate of destruction of the seal

- Certificate of closing of accounts

- Bank refusal to carry out banking operations (depending on the bank): Banks may refuse to carry out operations if the current authority of the director is not confirmed

- Inability to confirm the powers of the executive body to counterparties: Without official confirmation of the director’s powers, counterparties may refuse to conclude transactions, which will lead to difficulties in business relations

- Failure of transactions: The absence of confirmed powers may lead to blocking of transactions, which in turn may cause the failure of transactions and other serious consequences

- Publicly available personal data are personal data or information that, in accordance with the laws of the Republic of Kazakhstan, are not subject to confidentiality requirements, access to which is free with the consent of the subject (full name, residential address, telephone number, i.e. data provided voluntarily)

- Personal data of limited access are personal data, access to which is limited by the legislation of the Republic of Kazakhstan.

Article 7 of the Law of the Republic of Kazakhstan “On Personal Data and Their Protection” establishes that “The collection and processing of personal data is carried out by the owner and (or) operator, as well as a third party with the consent of the subject or his legal representative in the manner determined by the authorized body” - Inform users about the purposes of collecting personal data

- Obtain explicit consent for their processing

- Ensure the security of this data

- labor immigrants – immigrants who arrived in the Republic of Kazakhstan as domestic workers for the purpose of performing work (providing services) for employers – individuals in the household on the basis of a permit for a labor immigrant;

- permit for a labor immigrant – a permit for a labor immigrant – a document of the established form issued to a labor immigrant for performing work (providing services) for employers – individuals in the household;

- employer-individual – a person attracting a labor immigrant to perform work (provide services) in the household;

- quota for attracting foreign labor – the maximum permissible number of foreign labor permitted to be attracted by an employer-individual for carrying out labor activities in the territory of the Republic of Kazakhstan.

- Employee salaries;

- Social and pension contributions;

- Taxes provided by law.

- Declaration form 910.00 indicates the total turnover for the sale of goods, works and services.

- Turnover is not the net income of the individual entrepreneur, since it also includes:

- Payment of wages to employees;

- Social and pension contributions;

- Tax deductions.

- Net income will only be obtained after all obligations have been fulfilled.

- Provide complete and reliable data on your income and expenses: accounting documents, employment contracts, tax returns.

- Make sure that alimony is calculated based on net income, and not in total.

- In case of disputes with the provisions of the ChSI, contact professional lawyers to protect your interests.

2. Patent examination – proved the lack of value of the “innovation”

3. Judicial protection – achieved recognition of the transactions as invalid

Result:

Why should you contact KORGAN?

Don’t wait for the losses to grow! If you have been misled or unfavorable conditions are imposed, we will help you terminate the contract and get your money back.

Contacts for urgent assistance

📞 +7 700 5000 553

✉ korgancompany@gmail.com

«KORGAN» is your reliable defender in court!

Registration of BIN and EDS for the Croatian company KORGAN in one week: the experience of our law firm

Our law firm was approached by a Croatian state-owned company that planned to participate in a competition (tender) in the Republic of Kazakhstan.

The client’s main request was to promptly obtain a BIN (business identification number) and an EDS (electronic digital signature) in a short time.

The client’s company is a legal entity with 100% participation of the state of Croatia, and working with such structures requires a high degree of accuracy, transparency and compliance with international standards of document flow.

What is a BIN and why is it needed?

A BIN (business identification number) is a unique number assigned to legal entities and individual entrepreneurs in Kazakhstan.

It is used in all legal and financial transactions, including tax reporting, participation in government procurement and signing official documents.

Without a BIN, it is impossible to obtain an EDS and participate in tenders.

Documents required to obtain a BIN

The following documents were prepared and submitted to obtain a BIN:

All documents were apostilled, confirming their legal force in the territory of Kazakhstan, and notarized copies were made by a Notary of the Republic of Kazakhstan in accordance with the requirements of local legislation.

What is required to obtain an EDS for a foreign company?

Tight deadlines and an individual approach

The deadlines were extremely tight – it was necessary to meet the deadline of one week. This required our team to be highly coordinated, flexible and have a deep understanding of bureaucratic procedures.

We worked actively with government agencies, including agreeing on an expedited review of the application, thanks to which it was possible not only to obtain the BIN in a timely manner, but also to issue an EDS for the client.

Result

Within 5 working days Croatian company:

This project has become another confirmation of our ability to work promptly, professionally and in full compliance with the law, even under tight deadlines and with the participation of foreign government agencies. If your company needs to register in Kazakhstan, receive a BIN or EDS, we are ready to help in the shortest possible time submitted to the Registration Authority at the place of registration of the owner of the property.

Why us?

If your company needs to register in Kazakhstan, obtain a BIN or EDS in a short time – we are ready to take on the entire legal part and guarantee the result. Contact us – we know how to do it quickly, legally and effectively.

KORGAN Law Firm is ready to provide assistance at every stage of this process, providing competent support and assistance in preparing all the necessary documents.

Contact us right now to get a free consultation and trust the experience of professionals in working with KORGAN!

Contact our specialists by phone +7 700 50 00 553 or click on the “order a call” button below.

Risks of the absence of constituent documents: what is important for an entrepreneur to know

In the course of providing legal services, our company is increasingly faced with the fact that most entrepreneurs do not have constituent documents on hand.

According to the Civil Code of the Republic of Kazakhstan, Article 41, paragraph 1, the list of constituent documents includes such documents as: a constituent agreement, a decision to establish a company, and the Charter.

There is another document that is not included in the list of constituent documents of an LLP, but is always requested by any government agency, when such a need arises, and by many of your partners and counterparties – an order on the assumption of office of the first manager (director).

What risks does an entrepreneur bear who does not have constituent documents?

The fact is that the absence or incorrect execution of constituent documents can lead to: serious legal consequences, undermining the trust of partners and other inconveniences in the course of entrepreneurial activity.

The presence of properly executed constituent documents is not only the basis for the legal protection of your business, but also the basis for the further growth and development of your Business.

Contact us right now to get advice and trust the experience of professionals in working with KORGAN!

Contact our specialists by phone +7 700 50 00 553 or click on the “order a call” button below.

Author of the article: Kenzhemergenova M.N.

Religious Practices in the Workplace: Discrimination or Violation of Labor Conditions?

Our company is regularly contacted by clients with labor disputes. Be it employers or employees. Recently, our regular clients contacted us with a problem. Their former employee wrote a pre-trial claim to the Employer citing discrimination, due to the fact that the employer asked not to read Namaz in the workplace. By the way, the workplace is a store. That is, the place is not conducive to conducting such rituals. Let’s turn to labor legislation and see what we consider discrimination in labor.

Article 6 of the Labor Code of the Republic of Kazakhstan establishes that “No one can be subject to any discrimination in the implementation of labor rights on the grounds of origin, social, official and property status, gender, race, nationality, language, attitude to religion, beliefs, place of residence, age or physical disabilities, membership in public associations or other circumstances.”

Now let’s define what is considered discrimination in labor?

Discrimination in labor is the infringement of the rights of citizens, namely the individual, on any basis (age, race, gender, social status, etc.) by the employer in the labor rights established by law.

The legislation of the Republic of Kazakhstan does not provide for the employer’s obligation to provide additional time, place and opportunity for Employees to conduct religious rites. Of course, this condition can be stipulated when hiring, but in the case of our clients, this was not the case.

Moreover, the Supreme Mufti of Kazakhstan gave an explanation on this topic – and there it was also explained that the employer’s requirement not to conduct religious rites is not an infringement.

In addition, the Employee has the opportunity to change jobs to one where the performance of religious rites does not interfere with the activities of the enterprise.

Voluntary liquidation of LLP: how to avoid mistakes in the process of closing a company in Kazakhstan

Liquidation of a company is a complex and responsible process that requires careful preparation and implementation of certain procedures. In this article, we will consider the main stages and recommendations for the effective liquidation of an LLP in Kazakhstan.

The process of terminating the activities of a legal entity includes several stages, compliance with the deadlines established for each of the stages, preparation of a large number of documents and requires compliance with all legal norms.

Main stages of liquidation of an LLP

Step 1 – Preparation and adoption of a decision on liquidation

Before starting the liquidation procedure of an LLP, it is necessary to make a decision on liquidation of the company at a general meeting. This decision is recorded in the minutes or a decision if the founders have one participant.

Step 2 – Appointment of a liquidation commission

The commission will monitor and coordinate the liquidation process, which consists of representatives of the LLP (director, accountant, other key employees). The powers and composition of the commission are approved at a general meeting of participants and are formalized in the relevant minutes or decision.

Step 3 – Notification of Liquidation of LLP

In addition to sending notices to interested parties, it is necessary to publish an announcement of liquidation in newspapers of national significance. This should contain information on the deadlines for accepting claims from creditors, at least 2 months from the date of publication.

Step 4 – Drawing up an interim liquidation balance sheet, preparing liquidation tax reporting, etc.

Two months from the date of publication of the announcement, it is necessary to draw up an interim liquidation balance sheet and prepare liquidation tax reporting.

Step 5 – Closing accounts and deregistering cash registers

It is necessary to close all LLP accounts in banks and provide certificates of account closure to the State Revenue Department of the Ministry of Finance of the Republic of Kazakhstan. If there is a cash register machine (KKM), it should also be deregistered.

Step 6 – Drawing up a certificate of destruction of the seal

Step 7 – Submitting documents to the registration authority

Liquidation Periods of an LLC

The liquidation period of an LLC is from 2 months

All actions for closing an LLC are carried out officially in accordance with the current legislation of the Republic of Kazakhstan, where there are standard terms for each stage. The service is carried out within these terms and, unfortunately, it is impossible to speed them up.

Documents required for liquidation of LLP:

Liquidation of LLP is a serious process that requires precision, attention to detail and knowledge of the law. In this process, it is important to correctly go through all the stages in order to avoid legal consequences and possible financial losses.

The KORGAN law firm is ready to provide assistance at every stage of this process, providing competent support and assistance in the preparation of all necessary documents.

Contact us right now to get advice and trust the experience of professionals in working with KORGAN!

Contact our specialists by phone +7 700 50 00 553 or click on the “order a call” button below.

Author of the article: Kenzhemergenova M.N.

Protecting the client’s interests: successful defense against an unfounded claim

One of our regular clients contacted KORGAN Law Firm after he faced an unfounded claim from his supplier. The plaintiff claimed that our client had a debt for goods purchased as part of a business relationship. However, during the trial it was established that all obligations had been fulfilled in full, the goods had been paid for in full, and there was no debt.

From the very beginning of our involvement in the case, we carefully studied all the circumstances and documents confirming the payment for the goods and the fulfillment of the terms of the contract. Based on the evidence presented and legal analysis, we developed a defense strategy aimed at completely refuting the plaintiff’s claims. During the trial, it was proven that the supplier’s claims had no legal basis.

As a result of the court’s decision, in addition to satisfying our client’s claims, the court recovered from the defendant the costs incurred in connection with the trial in the amount of 1,463,511 tenge. This decision was confirmed by the Court of Appeal, which also ordered the reimbursement of legal costs in full, which became the final victory in this case.

This case is a vivid example of the importance of professional legal support in resolving disputes. Qualified protection of the client’s interests allowed not only to refute unfounded accusations, but also to achieve the return of all incurred costs. We believe that the right approach and detailed analysis of all aspects of the case play a decisive role in the successful outcome of litigation.

The decision made in this case confirmed the high level of professionalism and competence of our team. We continue to ensure effective protection of the interests of our clients, striving for the best result in each specific case.

KORGAN continues to provide highly qualified legal services that allow clients to confidently resolve any legal issues.

When contacting us, you receive a guarantee of the quality of the services provided, an individual approach and transparent cooperation.

With us, you will be confident in the safety and legality of your activities.

Contact us right now to get qualified advice and trust the experience of professionals in working with KORGAN!

How to extend the powers of a director of an LLP in Kazakhstan after a five-year term?

In accordance with paragraph 3 of Article 51 of the Law of the Republic of Kazakhstan “On Limited and Additional Liability Partnerships”, members of the executive body of the company are elected by the general meeting for a term not exceeding five years. Upon expiration of this term, the director’s powers must be extended.

The issue of extending the director’s powers is an important point for the legal correctness of the LLP’s work, since ignoring this procedure can lead to legal consequences. Let’s consider how to properly extend the director’s powers and what steps need to be taken for this.

How to extend the powers of an LLP director?

1. Making a decision

The first step to extend the powers of the director is the adoption of a decision by the founders of the company. This may be a decision of the sole participant or the minutes of the general meeting. Without this step, the extension of the director’s powers will be impossible.

2. Issuing an order to extend the powers and concluding an additional agreement to the employment contract

Based on the decision of the founders, the director issues an order to extend his powers. It is also important to conclude an additional agreement to the employment contract, which will specify the extension of the term of office. The wording of the order may be as follows: “Extend the powers of the director of LLP ________ (company name), full name, based on the decision of the founder dated ..____ year.”

3. Familiarization with the decision and order

After the order is issued and the additional agreement is concluded, the director must familiarize himself with the decision of the founders and the order on the extension of powers. This is a mandatory process confirming that all parties are aware of the decision made.

4. Registration of the agreement in the enbek.kz system

After signing the additional agreement, information about it must be entered into the unified system of accounting of employment contracts of the Republic of Kazakhstan – enbek.kz. This procedure is mandatory and helps to track all changes related to labor relations.

Important points:

Extension of the director’s powers does not require amendments to the constituent documents of the company, and does not require registration with the authorities exercising state control. Thus, there is no need to notify the registration authorities.

Why is it important to renew the director’s powers in a timely manner?

The need to renew the director’s powers in a timely manner arises not only due to legal requirements, but also to ensure stability in the management of the company. Neglecting this process can lead to a number of inconveniences:

Remember: timely contact with professionals helps to avoid serious problems in the future. KORGAN Law Firm is ready to provide qualified assistance in solving all issues related to corporate law and labor relations.

Trust your legal issues to KORGAN experts – focus on what is really important to you.

Contact us right now for a consultation! We are ready to help you with any legal issues. Call +7 700 50 00 553 or click the “order a call” button to get advice from our specialists.

Author of the article: Kenzhemergenova M.N.

Collection and processing of personal data

Is it necessary to tick the box on websites about consent to the collection and processing of personal data?

Let’s figure out what is considered personal data:

In accordance with this law, operators (websites, companies and other organizations) are obliged to:

Thus, the website must provide the user with the opportunity to consent to the processing of personal data, usually through a checkbox (or similar mechanism), before they are collected or processed.

Violation of legislation in the field of personal data entails administrative liability, namely fines in the amount of 10 to 70 MCI depending on the category of the business entity (Article 79 of the Code of Administrative Offenses of the Republic of Kazakhstan).

New rules for issuing permits to labor immigrants

From 2025, new Rules for issuing permits to labor immigrants will be introduced.

The rules have been supplemented with a number of concepts:

In addition, the procedure has been determined provision of public services through the e-government portal, as well as through the migration.enbek.kz platform.

The mechanism for issuing permits to labor immigrants for up to 12 months has been simplified, and the grounds for refusing to issue and extend permits have been defined.

When hiring a labor immigrant who has received a permit, the employer will be required to enter information about the conclusion and termination of an employment contract with the employee into the Unified System of Labor Registration and Documentation (USRTD) or conclude an employment contract with him on the hr.enbek.kz web portal.

Registration of employment contracts between the employer and the labor immigrant will be carried out by the service provider in the AIS “Foreign Labor”.

To receive a public service, an individual – a labor immigrant (hereinafter referred to as the service recipient) submits an application for the issuance/extension of a permit for a labor immigrant in the form according to Appendix 1 to these Rules in person to the non-profit joint-stock company “State Corporation “Government for Citizens” (hereinafter referred to as the State Corporation) or through the “electronic government” web portal or migration.enbek.kz documents in accordance with the List of Basic Requirements for the Provision of the Public Service “Issuance, Extension and Revocation of a Permit for a Labor Immigrant” in accordance with Appendix 2 to these Rules (hereinafter referred to as the Requirements for the Provision of the Public Service).

An employee of the State Corporation shall submit an electronic application in the Integrated Information System “Public Service Centers” (hereinafter referred to as IIS PSC), with attached electronic copies of documents, and send it to the Automated Information System “Foreign Labor Force” (hereinafter referred to as AIS IRS) for the appropriate decision.

When making a decision on issuing or extending a permit for a labor immigrant, local executive bodies shall coordinate this with the territorial internal affairs bodies.

The decision on issuing or extending or refusing to issue or extend a permit shall be made by local executive bodies within two working days, not counting the day of filing the application.

Declaration procedure for state registration of legal entities instead of notification

For small business entities, a declarative procedure for state registration of legal entities is introduced instead of a notification procedure.

For state registration of legal entities related to medium and large business entities with foreign participation, in addition to a copy of the passport or other document certifying the identity of the foreign founder, with a notarized translation into Kazakh and Russian, a document confirming the right to register a commercial organization in the Republic of Kazakhstan in accordance with the Law of the Republic of Kazakhstan “On Population Migration” will be required.

Failure to provide these documents serves as grounds for refusal of state registration.

In addition, it has been added that changes and additions to the registration data of a legal entity, branch (representative office) are made when contact information (phone, email address) changes. These changes are made automatically based on an electronic notification.

From January 7, 2025, the Rules for the provision of public services in the field of state registration of legal entities and the registration of branches and representative offices will change.

In particular, it is envisaged that state registration of a legal entity related to a small and medium-sized business entity is carried out by submitting an electronic application.

In the case of electronic registration, state registration of legal entities is carried out on the basis of an application received by the state database “Legal Entities” (SDB LE) through the portal.

To provide a public service in electronic form, biometric authentication of the individual may also be carried out.

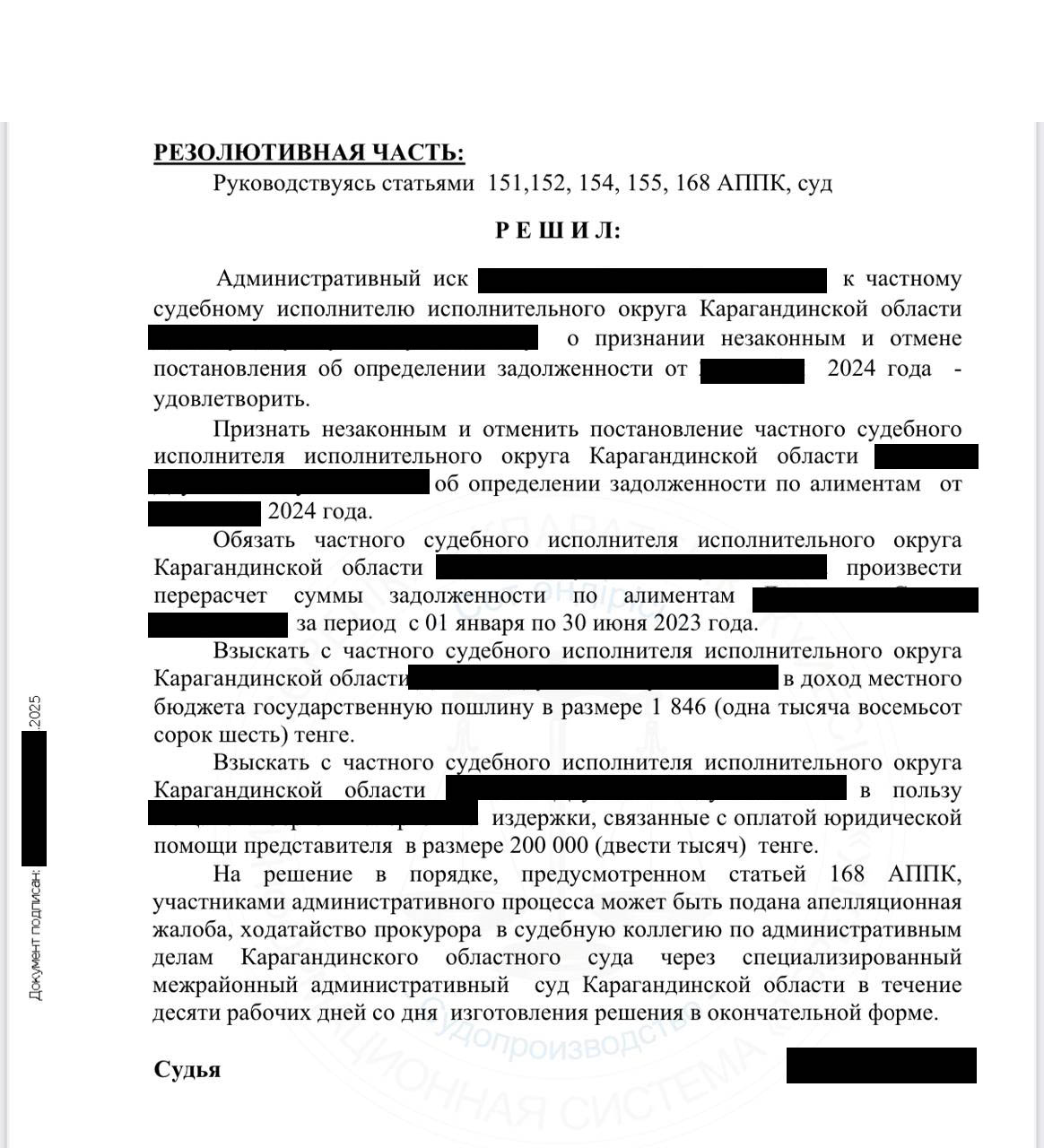

Victory in an administrative case: KORGAN defends the client’s interests in a dispute over alimony arrears

The KORGAN law firm proudly announces its successful work in protecting the interests of a client in a complex administrative case on calculating arrears in alimony.

Background of the case

Our client, who is an individual entrepreneur, faced an unjustified calculation of arrears in alimony made by a private bailiff (PBI). The calculation was made without taking into account the entrepreneur’s obligations and expenses, such as:

The CSI calculates the debt based solely on the turnover indicated in the tax return. However, this approach contradicts the norms of tax legislation, which require the responsibility of the entrepreneur when assessing his income.

Legislative basic calculation of alimony

The procedure for calculating alimony with income from debt is regulated taking into account the regulatory acts:

1. Law of the Republic of Kazakhstan No. 261-IV dated 02.04.2010 “Enforcement proceedings and the status of bailiffs” (Article 58), which establishes that deductions are calculated with the amount of income due to the debt received.

2. Order of the Minister of Justice No. 372 dated December 24, 2014, confirming the total income from which alimony is withheld. According to paragraph 11, alimony is withheld with income from entrepreneurial activity.

3. Administrative Procedure Code of the Republic of Kazakhstan (APC).

Features of calculating alimony for individual entrepreneurs

The procedure for calculating alimony from the salary and other income of the debtor is regulated by Law No. 261-IV of 02.04.2010 “On judicial proceedings and bailiffs”.

According to Art. 58 of this law, the amount of deductions is calculated from the amount of the debtor’s salary (income) due to him for receipt.

In accordance with the order of the Minister of Justice No. 372 of December 24, 2014, deductions for the maintenance of minor children are made from all types of wages (monetary remuneration, maintenance) and other income received by parents in monetary (national and (or) foreign currency), with the exception of the income of persons specified in indicator 2 of the specified list. In particular, this rule applies to income received from work in the entrepreneurial sphere without forming a legal entity.

For entrepreneurs using a special tax regime based on a simplified declaration (STR based on UD), the last line 910.00.001, reflected in form 910.00, represents the turnover from the sale of goods, works and services, which should not be considered as income of the individual entrepreneur for the calculation of alimony.

Income due to the individual entrepreneur to receive is formed only after filing tax returns and fulfilling obligations to pay salaries to employees, as well as paying all taxes and deductions for employees. The remaining net income is the actual income of the individual entrepreneur, which can be used at his own discretion.

Thus, the calculation of alimony in relation to an individual entrepreneur should be made exclusively from the amount of net income remaining after making and fulfilling all obligations for the reporting half-year. Accounting for the amount reflected in line 910.00.001 as total turnover, without appropriate adjustments to expenses, does not ensure the validity of the calculation of income for calculating alimony. Therefore, the calculation of alimony should be made from the amount of net income remaining after taxation for the reporting half-year.

Thus, when calculating alimony for entrepreneurs under the simplified system (SNR based on a simplified declaration), it is important to take into account that:

Errors in calculations and their consequences

In the case of an individual entrepreneur, the Private Judicial Enforcement Officer (PIO) determined the arrears in alimony and the final calculation was made on the basis of the total turnover indicated in the declaration form 910.00. However, this calculation did not take into account the individual entrepreneur’s expenses, which led to an overstatement of the alimony amount.

Court decision

The court found the ChSI ruling illegal, stating that the calculation was made without taking into account objectivity and reliability. The court ruled to cancel the ruling and obliged the ChSI to recalculate the debt taking into account the entrepreneur’s real net income.

Recommendations for entrepreneurs

The KORGAN law firm is ready to provide qualified assistance in such matters. We ensure fairness in calculations and protect your rights!

Contact our specialists by phone +7 700 50 00 553 or click on the “order a call” button below.

Author of the article: Berdysheva A.K.

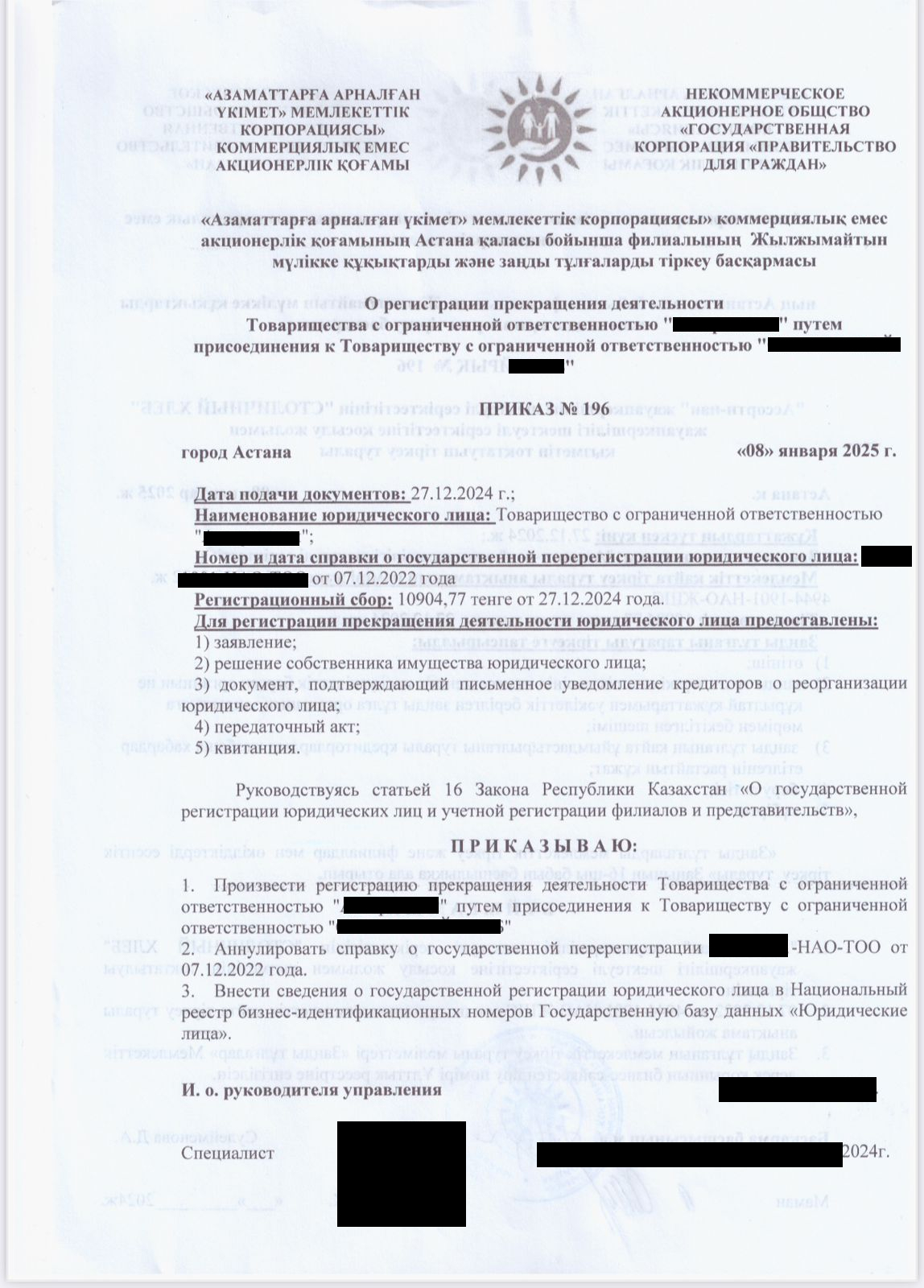

Successful registration of the merger of LLC with LLC

Our company’s lawyers successfully registered the merger of an LLC with an LLC. We provided full support for the process, guaranteeing compliance with all legal norms and requirements of current legislation.

The merger of two companies is a significant step to strengthen positions in the market and expand business opportunities. We took care of the careful preparation and execution of all necessary documents, and also provided qualified consulting support at each stage of the transaction. As a result, the process was quick and without complications, fully complying with legal standards.

The KORGAN law firm continues to provide professional assistance in resolving any issues of corporate law, including the reorganization of legal entities, mergers and other key processes that contribute to the development of your business.