Implementation of local acts and personnel documentation

Many companies neglect to maintain the necessary personnel documentation at the enterprise. However, the order in local and personnel documents is the key to the successful functioning of the enterprise. In order to avoid negative consequences, one should not neglect the correct maintenance of personnel records.

Law firm KORGAN provides legal assistance in the development, maintenance, execution, systematization of local acts and personnel documents. In this article, we would like to acquaint the business community with the responsibility for the absence of mandatory documents and what negative consequences the absence of certain personnel documents may incur.

Mandatory documents for the absence of which administrative responsibility is provided are:

- Employment contract (Fine in the amount of 30 to 300 MCI Art. 86 of the Code of Administrative Offenses);

- Consent to the collection and processing of personal data (Fine in the amount of 10 to 1000 MCI, Article 79 of the Code of Administrative Offenses);

- Instruction (program) on the procedure for conducting an introductory safety briefing (Fine in the amount of 30 to 70 MCI, Article 93 of the Code of Administrative Offenses);

- Safety magazines (Fine in the amount of 30 to 70 MCI Art. 93 of the Code of Administrative Offenses);

- Contract of compulsory insurance of employees against accidents (Fine in the amount of 10 to 1000 MCI Art. 230 of the Code of Administrative Offenses);

- Personal card T-2 (For persons liable for military service and conscripts) (Fine in the amount of 10 to 40 MCI Art. 646 of the Code of Administrative Offenses);

- Collective agreement (If its conclusion is initiated by one of the parties) (Penalty in the amount of 80 to 400 MCI Art. 97 of the Code of Administrative Offenses).

I would like to note that even if there are disagreements between the parties on certain provisions of the collective agreement, the parties must sign the collective agreement on agreed terms with the simultaneous preparation of a protocol of disagreements within 1 (one) month from the date of their occurrence. Disagreements that have arisen in the course of collective bargaining may be subject to further collective bargaining to resolve them when amendments and additions are made (Article 156 of the Labor Code of the Republic of Kazakhstan).

Mandatory documents, the absence of which can lead to negative consequences are:

1. Internal labor regulations

The presence of this document allows the Employer to regulate the labor schedule and prove, if necessary, the fact that the Employee has committed a disciplinary offense, which is problematic to do without the Labor Regulations.

2. Work Orders

The absence of orders for labor activity may lead to negative results during the inspection by the authorized body.

The order is the main document confirming this or that legal fact in labor relations and its absence will cause difficulties if it is necessary to prove such a fact. Restoring all orders is a rather laborious process, therefore it is important to issue them in a timely manner and monitor their relevance.

3. Provision (agreement) on non-disclosure of confidential information

In the absence of such a document, the Employee cannot be held liable for the disclosure or use of the Employer’s trade secret, database, know-how, inventions or developments of the Employer. Losses can be extremely significant and even lead to the bankruptcy of the company (for example, the departure of an employee to your competitors).

4. Non-Compete Agreement

The absence of such an Agreement may lead to the fact that the Employee, having become familiar with the algorithm of the Employer’s activities, will be able to apply the knowledge, skills, methods of work in his personal interests or in the interests of third parties in order to make a profit by competing with the Employer. Such a combination of circumstances can lead to financial losses and major losses for the Employer.

5. Liability Agreement

The absence of the Agreement can cause difficulties in bringing the Employee to liability for causing damage (losses) to the Employer and complicate the process of proving the fact of causing such damage, or even completely, eliminating the possibility of holding the Employee liable.

6. Additional agreement on the combination of positions

It is necessary only in case of situations that require the combination of positions by one employee.

It should be noted that the Labor Code of the Republic of Kazakhstan prescribes that for combining positions in an organization, the Employee is entitled to an appropriate additional payment.

In the absence of an agreement, there is a high probability of occurrence of risks in determining the volume of the actual labor activity and workload of the Employee, it is difficult to apply to him measures of responsibility for violation of labor discipline and bring him to liability for a combined position.

7. Shift Schedule

Such a document is used to standardize the work of shift workers and allows you to keep track of working time and rest time. Its absence contributes to negative results during labor inspections and difficulties in regulating shift work and wages.

Recommended documents, the absence of which can lead to negative consequences are:

1. Regulation on the collection and processing of personal data.

The presence of this document in the organization makes the process of collecting, processing and destroying personal information as clear, coherent and transparent as possible, which further reduces the risk of any liability for the Employer, given the fact that confidentiality requirements are becoming increasingly stringent on the part of authorized bodies .

2. Journal of registration of labor contracts.

According to the law, an employment contract must have a serial number. The lack of registration of labor documents in the general register of contracts can cause difficulties in their further search and identification. The presence of a separate register of employment contracts simplifies the procedure for assigning numbers and allows you to store information about contracts in one document.

3. Regulations on wages.

The Employer is obliged to pay wages, make mandatory deductions and payments for the Employee. At the same time, he has the right to encourage Employees. To establish a clear procedure for payments and deductions, it is recommended to develop and approve this document.

4. Staffing.

In general, the Labor Code of the Republic of Kazakhstan does not contain a definition of the staffing table and the obligation for the Employer to have it. However, in the text of the legal act, one can find references to the actions of the Employer, in which the staffing is necessary.

5. Vacation schedule.

The document is necessary so that the Employer can keep track of the time the Employees are on vacation and, taking this into account, timely organize the smooth operation of the organization: coordinate the combination of positions and prevent a collapse in which several key employees go on vacation at once. Also, the vacation schedule allows you to avoid liability under Art. 88 of the Code of Administrative Offenses).

6. Time sheet.

The Labor Code of the Republic of Kazakhstan provides for the obligation of the Employer to keep records of working time. At the same time, the Employer is not limited in the ways of fulfilling this obligation. However, keeping records through the time sheet can significantly optimize this process.

If you don’t know where to start or how to properly draw up the necessary local, personnel documents at the enterprise, KORGAN Law Company will help you with this. Having experience in this matter, we will help you put things in order in your documents.

License for construction and installation works II category

LLP “Legal company” KORGAN “was obtained a license for construction and installation works of category II.

Our company has done work on the preparation and submission of all necessary documentation to the authorized body.

Obtaining a license for construction and installation works of category II differs from the procedure for obtaining a license for construction and installation works of category III in terms of terms and required documentation.

The procedure for obtaining a license for construction and installation works is regulated by:

- Civil Code of the Republic of Kazakhstan (special part) dated July 1, 1999 No. 409-I (with amendments and additions as of 02.01.2021);

- The Law of the Republic of Kazakhstan “On Permits and Notifications” (as amended and supplemented as of 01.01.2021);

- The Law of the Republic of Kazakhstan “On architectural, urban planning and construction activities in the Republic of Kazakhstan” (as amended and supplemented as of 16.01.2021);

- By order of acting Minister of National Economy of the Republic of Kazakhstan dated December 9, 2014 No. 1636 “On approval of qualification requirements for the implementation of licensed architectural, urban planning and construction activities (as amended and supplemented as of July 30, 2019);

- By Order of the Minister of National Economy of the Republic of Kazakhstan dated February 28, 2015 No. 165. Registered with the Ministry of Justice of the Republic of Kazakhstan on April 9, 2015 No. 10666 “On approval of the Rules for determining the general procedure for classifying buildings and structures as technically and (or) technologically complex objects” .

To obtain a license for construction and installation of category II, you must have:

1. Availability of a production base on the right of ownership (economic management or operational management) and (or) lease;

If you want to obtain a license for construction and installation works of the II category, then you need to be patient and time, since the process of obtaining a license itself takes a long time, and KORGAN Law Company LLP will help you with this.

Trademark registration

Основная функция товарного знака (бренда, марки) – это обеспечить потенциального покупателя возможностью легко и просто отличать товары и услуги, производимые одной компанией от товаров и услуг других компаний.

Потребители, довольные определенной продукцией, в будущем пожелают вновь ее приобрести. Поэтому очень важно предоставить все условия для того, чтобы среди многообразия схожих товаров и услуг покупатель обратился именно к Вам и выбрал Ваш товар.

Товарные знаки играют ключевую роль в брендинговой и маркетинговой стратегиях, способствуя формированию имиджа и репутации компании в глазах покупателей. Репутация, в свою очередь, является фундаментом в формировании клиентской базы и повышении доверия к компании.

Не остается в стороне и психология: так, покупатели зачастую создают эмоциональную связь с брендами, товарами и услугами которых активно пользуются, а также с набором атрибутов и признаков, которые характерны продукции этих брендов.

Товарные знаки мотивируют и сотрудников фирмы. Так, наличие бренда вынуждает компании и их сотрудников постоянно вкладывать ресурсы и средства в повышение качества предоставляемых товаров/услуг для того, чтобы обеспечить постоянно растущие ожидания клиентов.

Тщательно подобранный и зарегистрированный товарный знак является ценным активом для многих компаний. Рыночная капитализация таких всемирно известных брендов, как Apple или Amazonпревышает триллионы долларов США. Причина этого кроется в ценности, которую придают клиенты известности бренда и его репутации. Это в конечном итоге приводит к тому, что большинство людей желают платить за продукцию, которая не только отвечает потребностям, но и выпускается под известными брендами, чья репутация и имидж непоколебимы.

Как следует из вышесказанного, владеть зарегистрированным товарным знаком (брендом) и выпускать под этим брендом продукцию (оказывать услуги) дает компаниям множество привилегий и преимуществ в условиях рыночной экономики. Более того, от зарегистрированного товарного знака выигрывают все: покупатели, компании и рынок.

Компаниям, желающим зарегистрировать свой товарный знак мы настоятельно рекомендуем обратиться в Юридическую компанию «KORGAN», специалисты которой сделают все необходимое за Вас.

Стоимость регистрации

Стоимость всей процедуры регистрации товарного знака равна общей сумме предварительной, полной экспертиз и работ, связанных с регистрацией товарного знака в государственном реестре, выдачей свидетельства и публикацией сведений о регистрации.

Стоимость регистрации товарного знака устанавливается законодательными актами в сфере регистрации товарного знака. На 2021 год стоимость процедуры регистрации товарного знака составляет:

Прием заявки и проведение предварительной экспертизы на регистрацию товарного знака – 16 599 тенге 52 тиын;

Проведение полной экспертизы товарного знака – 44 000 тенге 32 тиын;

Проведение работ, связанных с регистрацией товарного знака, знака обслуживания в государственном реестре, выдачей свидетельства и публикацией сведений о регистрации – 36 544 тенге 48 тиын.

Сроки оформления товарного знака

Что касается сроков регистрации товарного знака, то доводим до Вашего сведения, что вся процедура, начиная от подачи заявки через портал уполномоченного органа и заканчивая выдачей охранного документа занимает 8-12 месяцев.

Документы

Для подготовки и последующей подачи заявки требуются следующие документы:

Заявляемое обозначение – изображение товарного знака в электронном виде. Размер загружаемого изображения не менее 945px*945px (8см*8см 300dpi), а формат – PNG;

Перечень товаров и (или) услуг в соответствии с Международной классификацией товаров и услуг (МКТУ) – перечень товаров (услуг), представляемых компанией;

Доверенность на представителя;

Документ, подтверждающий оплату услуг экспертной организации по проведению экспертизы.

Примечание*: сотрудники ТОО «Юридическая компания «KORGAN» консультируют по каждому из вышеуказанных пунктов. Более того, проекты доверенности, перечень товаров и услуг согласно МКТУ представляется нашей компанией. Все, что требуется клиенту – это выбрать из предложенного списка то, что подходит под свой вид деятельности.

Срок действия товарного знака

Регистрация товарного знака действует в течение 10 (десяти) лет с даты подачи заявки. Срок действия регистрации товарного знака продлевается каждый раз на десять лет по ходатайству, поданному в течение последнего года ее действия.

*По всем интересующим вопросам Вы можете обратиться по тел.: +7 701 7058248

Supreme Court of the Republic of Kazakhstan contacts

010000, Astana, D. Kunaeva, 39

Work Schedule

Monday Friday

9:00 – 18:30

lunch break

13:00 – 14:30

Contacts of district courts of Karaganda region

Kazybekbiysky district court of Karaganda city (base court for criminal cases)

postal address: 100000, Karaganda, st. Krylova, 9

reception phone: 41-61-44

helpline: 41-61-44

email address: mc-30@m.sud.kz

phone numbers of incoming correspondence: 8(7212) 41-60-88, 41-48-13

District court No. 2 of the Kazybekbi district of Karaganda city (base court for civil cases)

postal address: 100000, Karaganda, st. Yerubaeva, 30

postal address: 42-59-73

helpline: 42-60-07

email address: mc-31@m.sud.kz

phone of incoming correspondence: 8(7212) 42-60-07

Zhezkazgan city court (regional base court)

postal address: 100600, Zhezkazgan, st. Gagarina, 42

reception phone: 8(7102) 76-78-78

helpline: 8(7102) 76-17-74, 76-12-10

email address: mc-28@m.sud.kz

incoming correspondence phone: 8 (7102) 76-12-15

Balkhash city court (regional base court)

postal address: 100300, Balkhash, st. Lenina, 44

reception phone: 8(71036) 4-87-06

Helpline: 8(71036) 4-87-06

e-mail address: ms-18@m.sud.kz

incoming correspondence phone: 8 (71036) 4-08-66

Oktyabrsky District Court of Karaganda

postal address: 100018, Karaganda, st. Magnitogorsk, 48

reception phone: 46-34-09

helpline: 31-09-90

email address: mc-4@m.sud.kz

phone numbers of incoming correspondence: 8(7212) 46-01-12, 31-11-03

District court No. 2 of the Oktyabrsky district of Karaganda

postal address: 100010, Karaganda, st. Friendship, 127-a

reception phone: 47-03-32

helpline: 47-48-00

email address: mc-5@m.sud.kz

phone numbers of incoming correspondence: 8(7212) 47-25-63, 47-21-52

District court No. 3 of the Oktyabrsky district of Karaganda

postal address: 100020, Karaganda, 22 microdistrict, 17/1

reception phone: 53-21-13

helpline: 53-39-30

email address: mc-6@m.sud.kz

phone of incoming mail: 8(7212) 53-21-12

Temirtau City Court

mailing address: 101400, Temirtau, Republic Ave., 36

reception phone: 8(7213) 91-35-64

helpline: 8(7213) 91-16-11

email address: mc-26@m.sud.kz

phone of incoming correspondence: 8 (7213) 91-69-75 ext.129

Shakhty City Court

postal address: 101600, Shakhtinsk, st. 40 years of Victory, 48 in

reception phone: 8 (72156) 42-3-44

helpline: 8 (72156) 42-3-44

email address: mc-7@m.sud.kz

incoming correspondence phone: 8 (72156) 50-0-32

Saransk City Court

postal address: 101202, Saran, st. Miner, 44 b

reception phone: 8(72137) 4-25-57

helpline: 8(72137) 2-56-96

email address: mc-32@m.sud.kz

incoming correspondence phone: 8 (72137) 2-59-00

Abay District Court

postal address: 100101, Abay, Marksa st., 34

reception phone: 8(72131) 4-36-06

helpline: 8(72131) 4-27-84

email address: mc-9@m.sud.kz

phone of incoming correspondence: 8 (72131) 43-4-44 (reception is conducted by the leading specialist Sharipzhanov Aidar Sergazievich)

District court No. 2 of the Abay region

postal address: 100116, Abay district, Topar village, per. Hospital, 3

reception phone: 8(72153) 3-26-96

helpline: 8(72153) 3-22-38

email address: mc-10@m.sud.kz

incoming correspondence phone: 8 (72153) 3-33-59

Osakarovsky District Court

mailing address: 101000, Osakarovsky district, Osakarovsky district court

Osakarovka village, Litvinovskaya street 71

reception phone: 8(72149) 4-22-08

Helpline: 8(72149) 4-22-08

email address: mc-13@m.sud.kz

phone numbers of incoming correspondence: 8 (72149) 4-22-08, 8 (72149) 4-22-51

District court №2 of Osakarovskiy district

postal address: 101012, Osakarovsky district, Molodezhny settlement, st. Lenina, 34

reception phone: 8(72148) 2-14-43

helpline: 8(72148) 2-14-42

email address: mc-14@m.sud.kz

phone of incoming correspondence: 8 (72148) 21-4-42

Nurinsky District Court

postal address: 100900, Nurinsky district, Kievka settlement, st. Abaya, 46

reception phone: 8(72144) 21-6-49

helpline: 8(72144) 22-3-48

email address: mc-15@m.sud.kz

incoming correspondence phone: 8 (72144) 21-6-49

Bukhar-Zhyrau District Court

postal address: 100400, Bukhar-Zhyrau district, Botakara settlement, st. Abylaikhan, 32

reception phone: 8(72154) 3-14-28

helpline: 8(72154) 2-12-81

email address: mc-11@m.sud.kz

phone of incoming correspondence: 8 (72154) 2-17-85 ext.109

District court №2 of Bukhar-Zhyrau region

postal address: 100407, Bukhar-Zhyrau district, settlement Mustafina, st. Mira, 21

reception phone: 8(72138) 3-10-08

Helpline: 8(72138) 3-10-60

email address: mc-12@m.sud.kz

incoming correspondence phone: 8 (72138) 3-10-12

Karkaraly District Court

mailing address: 100800, Karkaralinsk, N. Abdirov St., 17

reception phone: 8(72146) 3-14-28

helpline: 8(72146) 3-14-28

email address: mc-16@m.sud.kz

incoming correspondence phone: 8 (72146) 3-17-00

District court №2 of Karkaraly region

postal address: 100810, Karkaraly district, s. Egindybulak, st. Kazybek bi, 12

reception phone: 8(72146) 9-12-86

helpline: 8(72146) 9-12-86

email address: mc-17@m.sud.kz

phone numbers of incoming correspondence: 8 (72147) 9-12-86, 9-12-70

Satpayev City Court

postal address: 101300, Satpayev, st. Abay, 60

reception phone: 8(71063) 3-34-06

Helpline: 8(71063) 3-68-23

email address: mc-33@m.sud.kz

incoming correspondence phone: 8 (71063) 3-77-62

Ulytau District Court

postal address: 101500, Ulytau district, s. Ulytau, st. Abaya, 1

reception phone: 8(71035) 2-12-85

helpline: 8(71035) 2-12-85

email address: mc-23@m.sud.kz

incoming correspondence phone: 8 (71035) 2-12-85

District court №2 of Ulytau region

postal address: 101508, Ulytau district, Zhezdy settlement, st. Kutymbetova, 37

reception phone: 8(71034) 2-10-15

helpline: 8(71034) 2-17-99

email address: mc-24@m.sud.kz

incoming correspondence phone: 8 (71034) 2-17-99

Shet District Court

postal address: 101700, Shetsky district, s. Aksu-Ayuly St. Shortanbay Zhyrau, 2

reception phone: 8(71031) 22-3-66

helpline: 8(71031) 21-9-42

email address: mc-21@m.sud.kz

incoming correspondence phone: 8 (71031) 21-6-14

District Court No. 2 of the Shet District

mailing address: 101700, Shetsky district, Agadyr settlement, Independence of Kazakhstan street, 10

reception phone: 8(71033) 2-77-00

helpline: 8(71033) 2-77-00

email address: mc-22@m.sud.kz

incoming correspondence phone: 8 (71033) 2-77-84

Karazhal City Court

postal address: 100700, Karazhal, st. Bitabara, 22

reception phone: 8(71032) 2-63-32

helpline: 8(71032) 2-63-32

email address: mc-34@m.sud.kz

phone of incoming correspondence: 8 (71032) 2-63-32 ext.108

Zhanaarkinsky District Court

mailing address: 100500, Atasu settlement, Seifullin avenue, 16

reception phone: 8(71030) 2-74-95

helpline: 8(71030) 2-74-95

email address: mc-20@m.sud.kz

incoming correspondence phone: 8 (71030) 2-66-80

Priozersky City Court

postal address: 101100, Priozersk, st. Agybay batyr 10

reception phone: 8(71039) 5-40-10

helpline: 8(71039) 5-40-92

email address: mc-35@m.sud.kz

incoming correspondence phone: 8 (71039) 5-40-62

Aktogay District Court

mailing address: 100200, Aktogay district, Aktogay settlement, st. Bukeikhana, 1

reception phone: 8(71037) 2-12-46

helpline: 8(71037) 2-18-62

email address: mc-36@m.sud.kz

incoming correspondence phone: 8 (71037) 2-11-46

District court №2 of Aktogay region

mailing address: 100316, Aktogay district, Shashubay village, Zhagypar Akbergenuly st., 15a

reception phone: 8(71038) 2-12-47

helpline: 8(71038) 2-12-47

email address: mc-25@m.sud.kz

incoming correspondence phone: 8 (71038) 2-11-05

Specialized courts:

Specialized Interdistrict Juvenile Court of Karaganda Region

Postal address: 100019, Karaganda, st. Zhambyla, 9

Reception phone: 8(7212) 43-52-63

Helpline: 8(7212) 42-02-09

Email address: m-35-1@ma.sud.kz

Phone of the incoming office: 8(7212) 50-35-31

Specialized Interdistrict Economic Court of Karaganda Region

postal address: 100000, Karaganda, st. Alalykina, 9

reception phone: 42-52-89

helpline: 42-42-30

email address: 721-2460@sud.kz

incoming correspondence phone: 8(7212) 432363

Specialized Interdistrict Court for Criminal Cases in Karaganda Region

mailing address: 100000, Karaganda, Krylova st., 9

reception phone: 33-74-68

helpline: 33-74-21

email address: mc-37@m.sud.kz

phone of incoming mail: 8(7212) 41-47-11

Specialized Interdistrict Administrative Court of Karaganda

postal address: 100000, Karaganda, st. Zhambula, 9

watch phone: 43-23-63

reception phone: 42-01-51

helpline: 42-02-63

email address: mc-2@m.sud.kz

phone of incoming mail: 8(7212) 42-53-36

Specialized Administrative Court of Temirtau

postal address: 101400, Temirtau, Komsomolsky Ave., 89/1

reception phone: 8(7213) 93-37-70

helpline: 8(7213) 95-43-29

email address: mc-27@m.sud.kz

incoming correspondence phone: 8 (7213) 91-78-94

Specialized Administrative Court of Shakhtinsk

mailing address: 101600, Shakhtinsk, 40 years of Victory, 48 v

reception phone: 8(72156) 5-18-90

helpline: 8(72156) 5-18-90

email address: mc-8@m.sud.kz

incoming correspondence phone: 8 (72156) 5-12-82

Specialized Administrative Court of Zhezkazgan

mailing address: 100600, Zhezkazgan, Taradaya st., 4

reception phone: 8(7102) 72-41-63

helpline: 8(7102) 72-37-00

email address: mc-29@m.sud.kz

incoming correspondence phone: 8 (7102) 724163

Specialized Administrative Court of Balkhash

mailing address: 100300, Balkhash, Lenin street, 44

reception phone: 8(71036) 4-03-36

helpline: 8(71036) 4-03-36

email address: mc-19@m.sud.kz

incoming correspondence phone: 8 (71036) 6-50-30

Requisites for paying the state fee to the Supreme Court of the Republic of Kazakhstan

Requisites for transferring the state fee for consideration of complaints in the supervisory authority (Supreme Court of the Republic of Kazakhstan)

Beneficiary: Republican State Institution “State Revenue Administration for Yesil District of the State Revenue Department for the city of Astana of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan”

BIN: 081240013779

IIC: KZ24070105KSN0000000

Beneficiary’s bank: State Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan

NIC: KKMFKZ2A

Tax authority code: 6205

KBK

108125 “State duty credited to the republican budget” includes the state duty on claims submitted to state institutions and is credited 100% to the republican budget.

108126 “State fee credited to the local budget” includes the state fee levied on statements of claim, statements of action proceedings, applications (complaints) in cases of special proceedings, applications for issuing a court order, applications for re-issuance judicial acts, appeals, cassation complaints, petitions for the revision of a judicial act in the order of supervision and other documents, and with the exception of the state duty from claims submitted to the court against state institutions and 100% is credited to the local budget.

206108 Other non-tax revenues to the republican budget, except for revenues from organizations in the oil sector

KNP 911

Change of legal address LLP

In the process of activity, sometimes there is a need to change the place of activity, in order to avoid administrative responsibility:

item 2 of Art. 466 of the Code of Administrative Offenses of the Republic of Kazakhstan: Untimely notification of the registering authority about a change in the location of a legal entity –

entails a warning or a fine on officials, small businesses or non-profit organizations in the amount of five, on medium businesses – in the amount of ten, on large businesses – in the amount of thirty monthly calculation indices.

To change the address, first of all, you need to select a new location and issue supporting documents:

- Contract-lease of premises / building / structure, etc.;

- Contract of sale;

- Notarized consent of the individual owner.

After that, through the EGOV portal, it will be necessary to request a certificate of clarification of the location of the property, which will indicate the registration code of the address of the property/land plot.

It will also be necessary to draw up internal documents, which include the Decision / Protocol and notification of the NAO about the change of legal address.

There are three ways to change your address:

- Via a special service on the EGOV portal, if you have a digital signature;

- Also on the EGOV portal, but via emails;

- And having gone to the branch of the Nenets Autonomous Okrug, handing over the documents in person, if the LLP does not have an EDS.

The period during which changes are made to the database of legal entities is set at five working days.

If you need to change the location of your LLP, then you can contact the law firm KORGAN at any time.

Reorganization by spin-off

There are several types of reorganization of a legal entity, one of them is spin-off. The extraction process itself takes a long time.

Our company carried out such a reorganization procedure in the form of a spin-off.

Art. 46 of the Civil Code of the Republic of Kazakhstan states that “When one or more legal entities are separated from a legal entity, the rights and obligations of the reorganized legal entity are transferred to each of them in accordance with the separation balance sheet.”

The separation begins with the adoption of the Decision, on the basis of which a preliminary separation balance sheet is drawn up, a notification is submitted to the media.

It is also necessary to notify creditors of the reorganization of a legal entity by sending them a copy of the separation balance sheet and notification.

Only after the submission of notifications, the countdown of two months begins, during which creditors have the right to demand repayment of the debt.

If no objections are received from creditors after two months, the legal entity may continue the reorganization process.

Documents for registration of a separate legal entity are submitted to the PSC department and a registration fee of 2 MCI + 12% is paid

Already after the registration of the separated legal entity, it is possible to transfer assets to it on the basis of a separation balance sheet and carry out the process of reducing the authorized capital of the main legal entity, on account of which the authorized capital of the separated legal entity was created.

To reorganize your legal entity, you can contact our company at any time.

Requisites for paying the state fee to the courts of the city of Karaganda

Specialized Interdistrict Economic Court of Karaganda Region

Recipient (beneficiary) Department of State Revenues for the district. Kazybek bi

Beneficiary’s bank (beneficiary’s bank)

SE “Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan”

IIK KZ24070105KSN0000000

BIC KKMFKZ2A

BIN 950740000498

KBK 108126

KNP 991

Kazybekbi District Court of Karaganda

Back to news »

District court No. 2 of the Kazybekbi district of the city of Karaganda

Recipient (beneficiary) Department of State Revenues for the district. Kazybek bi

Beneficiary’s bank (beneficiary’s bank)

SE “Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan”

IIK KZ24070105KSN0000000

BIC KKMFKZ2A

BIN 950740000498

KBK 108126

KNP 991

Oktyabrsky District Court of Karaganda

District court No. 2 of the Oktyabrsky district of Karaganda

District court No. 3 of the Oktyabrsky district of Karaganda

Recipient (beneficiary) Department of State Revenues for Oktyabrsky District

Beneficiary’s bank (beneficiary’s bank)

SE “Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan”

IIK KZ24070105KSN0000000

BIC KKMFKZ2A

BIN 980940001111

KBK 108126

KNP 991

Temirtau City Court

Recipient (beneficiary) Department of State Revenues for the city of Temirtau

Beneficiary’s bank (beneficiary’s bank)

SE “Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan”

IIK KZ24070105KSN0000000

BIC KKMFKZ2A

BIN 950540000371

KBK 108126

KNP 991

Shakhty City Court

Recipient (beneficiary) Department of State Revenues for the city of Shakhtinsk

Beneficiary’s bank (beneficiary’s bank)

SE “Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan”

IIK KZ24070105KSN0000000

BIC KKMFKZ2A

BIN 981240000953

KBK 108126

KNP 991

Abay District Court

District court No. 2 of the Abay region

Recipient (beneficiary) Department of State Revenues for the city of Shakhtinsk

Beneficiary’s bank (beneficiary’s bank)

SE “Committee of the Treasury of the Ministry of Finance of the Republic of Kazakhstan”

IIK KZ24070105KSN0000000

BIC KKMFKZ2A

BIN 980640000886

KBK 108126

KNP 991

Case won in the Supreme Court of the Republic of Kazakhstan

The law firm KORGAN won the case on the recognition of the state re-registration of a legal entity as invalid and its cancellation in the Supreme Court of the Republic of Kazakhstan.

In 2017, the tax authority filed a lawsuit to recognize the state re-registration of a legal entity as invalid and cancel it. Our client was previously the founder and head of this legal entity. In 2017, the court dismissed the claim of the Tax Authority.

However, in 2018, the Tax Authority again went to court with exactly the same claim, despite the fact that this is not allowed in accordance with the requirements of the law. And the court, in violation of the requirements of the law, considered the case and, moreover, satisfied the requirements of the Tax Authority, i.e. declared the state re-registration of a legal entity invalid and canceled it.

As for our client, she was not properly notified of the time and place of the hearing, which is an unconditional basis for the annulment of the court decision. And since our client could not participate in the court session, she could not provide evidence that the arguments of the Tax Authority were unfounded, and the decision on this case had already been made earlier. The Court of Appeal also refused to restore justice, referring to the fact that the time limit for filing an appeal had expired.

Dmitry Matsura, Senior Associate at KORGAN Law Firm, managed to resolve the issue in the Supreme Court of the Republic of Kazakhstan. Thus, a Request for submission was sent to the Chairman of the Supreme Court of the Republic of Kazakhstan. This petition was granted and the Chairman submitted a proposal to review the decision of the court of first instance, after which this case was considered by the Supreme Court of the Republic of Kazakhstan and the illegal decision that violated the rights of our client was canceled.

Thus, the law firm KORGAN, represented by Senior Associate Matsur D.L., managed to achieve justice for the client and ensure proper protection of his rights and interests. Our company once again proved by the example of this case that we go to the bitter end with our clients.

Registration of a legal entity in Kazakhstan

A limited liability partnership (hereinafter referred to as LLP) is one of the most common organizational and legal forms of registration of a legal entity in the territory of the Republic of Kazakhstan.

The Civil Code of the Republic of Kazakhstan provides the following definition for an LLP: A limited liability partnership is a partnership established by one or more persons, the authorized capital of which is divided into shares of sizes determined by the constituent documents; participants in a limited liability partnership are not liable for its obligations and bear the risk of losses associated with the activities of the partnership, to the extent of the value of their contributions. Exceptions to this rule may be provided for by this Code and legislative acts. Participants in a limited liability partnership who have not fully made contributions shall be jointly and severally liable for its obligations to the extent of the value of the unpaid part of the contribution of each of the participants (Article 77).

Depending on the amount of annual income and type of activity, you can register a small, medium or large business.

The Entrepreneurial Code establishes the types of activities that small businesses cannot engage in:

- activities related to the circulation of narcotic drugs, psychotropic substances and precursors;

- production and (or) wholesale of excisable products;

- grain storage activities at grain receiving points;

- running a lottery;

- activities in the field of gambling;

- activities related to the circulation of radioactive materials;

- banking activities (or certain types of banking operations) and activities in the insurance market (except for the activities of an insurance agent);

- auditing activities;

- professional activity in the securities market;

- activities of credit bureaus;

- security activities;

- activities related to the circulation of civilian and service weapons and cartridges for them.

After choosing an activity, the question arises with the location of the future LLP, it can be own or rented real estate. The EGOV portal asks for a certificate of clarification of location, which will indicate the registration code of the address (RCA) of the LLP.

The name of the LLP is checked through the EGOV portal to avoid a match, a special service is provided for this.

The next item is the authorized capital, the minimum amount established by law for medium-sized businesses is 100 MCI, for small businesses it is zero.

It should also be determined with the taxation regime and with VAT.

Depending on the number of founders, a Decision (1 founder) or Protocol (2 or more) on registration of the LLP is drawn up. If there are more than 2 founders, the Memorandum of Association is additionally drawn up.

The Decision/Protocol on the registration of the LLP contains the following items:

- On LLP registration;

- Approval of the Charter;

- Appointment of the Director of the LLP;

- Registration of an LLP in the NAO.

The next mandatory internal document for registration, after the Decision and the Articles of Association, is the Order on taking office of the Director of the LLP.

After all internal documents (Decision/Minutes, Articles of Association, Order) have been prepared, a certificate from the RCA of the location of the LLP has been received, it is possible to apply for registration of the LLP. You can do this in two ways:

- Submit a package of documents through the nearest PSC department;v

- Through the EGOV portal, if all founders have an EDS.

The deadline for registration is one business day following the day the application is submitted. After that, you already receive a Certificate of registration of LLP and BIN.

This completes the LLP registration process.

The amount of the authorized capital will need to be credited to the account of the LLP in the bank within one year after the registration of the LLP.

If you have any difficulties with registration and you need the help of our specialist, then you can contact the phone numbers listed in Contacts or:

7172-779705

7212-360605

+7 701 7058248

Trademark registration

At a certain stage of its development, your brand product / service becomes recognizable to consumers and you are faced with the need to register a trademark, because a trademark is the No. 1 tool for distinguishing your goods and services from other manufacturers of goods and services.

In addition to individualization, a trademark in the eyes of a potential consumer of goods and services also acts as a guarantee of quality, because not every organization can afford not to be afraid to register a trademark and provide quality goods and services. Definitely, if your organization has a trademark, this cannot be ignored by the consumer, i.e. This is a kind of advertising for your business and brand.

And of course, if a trademark is registered for you, you can not be afraid of unfair competition, “dirty games” from other companies, because the legislation provides for liability for persons who sell your goods / services under their own name or, conversely, promote their goods under your name.

A trademark registered by the KORGAN law firm is a guarantee of transparent business conduct, without any fears about the use of your brand by other unscrupulous persons.

Trademark registration is regulated by the Law of the Republic of Kazakhstan “On Trademarks, Service Marks and Appellations of Origin of Goods” and other regulatory legal acts in the field of trademark registration. Trademark registration makes it possible to distinguish goods (services) of one person from similar goods (services) of other persons.

Below is information that includes information about the stages, terms, cost of registering a trademark, documents required for registration and the duration of the rights to a trademark.

To date, the following methods of filing an application and registering a trademark are available: on paper and by filing an electronic application. Filing an application through the electronic portal is the most optimal and appropriate way to register a trademark today for the following reasons:

1. The cost of preliminary and full examinations when filing an application electronically is significantly lower than when filing an application on paper, in which funds are additionally spent on postage of documents to the authorized body and other expenses;

2. Time and other resources will also be spent significantly less when submitting an application electronically than when submitting documents on paper, because the level of bureaucracy when interacting with the authorized body through the electronic portal is minimized.

In view of the foregoing, the information below includes the information required to register a trademark through an electronic application.

Trademark registration includes the following steps:

1. Collection of materials and preparation of an electronic application for registration of a trademark;

2. Issue by the authorized body in the field of trademark registration an invoice for payment for the services of an expert organization for the examination;

3. Payment and subsequent submission of an application through the portal of the authorized body;

4. Registration of an electronic application by an authorized body;

5. Preliminary examination of the application;

6. Full examination of the application;

7. Issuance of a title of protection.

Terms for registering a trademark

As for the terms of registration of a trademark, we bring to your attention that the entire procedure, from filing an application through the portal of the authorized body and ending with the issuance of a title of protection, takes 8-12 months.

Documents for registration

The following documents are required for the preparation and subsequent submission of an application:

- Declared designation – an image of a trademark in electronic form. The size of the uploaded image is at least 945px*945px (8cm*8cm 300 dpi), and the format is PNG;

- List of goods and (or) services in accordance with the International Classification of Goods and Services (ICGS) – a list of goods (services) provided by the company;

- Power of attorney for a representative;

- A document confirming payment for the services of an expert organization for the examination.

Note*: KORGAN law firm staff provide advice on each of the above points. Moreover, draft powers of attorney, a list of goods and services in accordance with the Nice Classification are submitted by our company. All that is required for the client is to choose from the proposed list what suits his type of activity.

Trademark registration fees

The cost of the entire procedure for registering a trademark is equal to the total amount of preliminary, full examinations and work related to the registration of a trademark in the state register, issuance of a certificate and publication of registration information.

The cost of registering a trademark is established by legislative acts in the field of trademark registration. To date, the cost of the procedure for registering a trademark is:

Acceptance of an application and conducting a preliminary examination for registration of a trademark – 14,109 tenge 59 tiyn;

Conducting a full examination of a trademark – 37,400 tenge 16 tiyn;

Carrying out work related to the registration of a trademark, service mark in the state register, issuance of a certificate and publication of registration information – 36,544 tenge 48 tiyn.

Trademark Validity

Trademark registration is valid for 10 (ten) years from the date of filing the application. The term of validity of a trademark registration is renewed each time for ten years at the request filed during the last year of its validity.

If you need help in registering a trademark, then the lawyers of the law firm KORGAN will help you to obtain legal protection of a trademark for your goods and services without errors and paperwork.

For all your questions, you can contact the following phone numbers +7 701 7058248, 7172 779705

How to get a license for construction and installation works

The issue of obtaining a license for construction and installation works is regulated by a number of regulatory legal acts. These include: Law of the Republic of Kazakhstan “On Permits and Notifications”, Order acting. Minister of National Economy of the Republic of Kazakhstan dated December 9, 2014 No. 136 “On approval of uniform qualification requirements for the implementation of licensed architectural, urban planning and construction activities”, Law of the Republic of Kazakhstan “On architectural, urban planning and construction activities in the Republic of Kazakhstan”.

The license for construction and installation works is divided into three categories.

According to the Order and.about. The Minister of National Economy of the Republic of Kazakhstan dated December 9, 2014 No. 136 “On approval of uniform qualification requirements for the implementation of licensed architectural, urban planning and construction activities” has the following requirements.

To obtain a license for construction and installation works of category III, you must:

- The presence of at least one certified engineering and technical worker in the state who has the appropriate certificate for the profile of work that is part of the requested subspecies of the licensed type of activity and works on a permanent basis with the applicant;

- The presence of a production base on the right of ownership (economic management or operational management) and (or) lease for a period of at least one year (with state registration in the legal cadastre), equipped with:

- administrative and industrial buildings or premises necessary for the performance of the declared types of work, a subspecies of the licensed type of activity. At the same time, administrative, production and other buildings or premises of the production base can be combined, if this does not contradict the requirements of the labor protection and safety system during work, and also does not violate the working conditions of administrative, technical and production workers.

- workplaces organized according to working conditions;

- The presence of a minimum material and technical equipment on the right of ownership (economic management or operational management) and (or) lease, including a minimum set of equipment, instrumentation, machines and mechanisms that are installed in accordance with the technical requirements for the implementation of construction and installation works, depending on the technical requirements for the declared works of the subspecies of the licensed type of activity.

To obtain a license for construction and installation works of category II:

- The presence of a production base on the right of ownership (economic management or operational management) and (or) lease for a period of at least one year (with state registration in the legal cadastre), equipped with:

- administrative and industrial buildings or premises necessary for the performance of the declared types of work, a subspecies of the licensed type of activity. At the same time, administrative, production and other buildings or premises of the production base can be combined, if this does not contradict the requirements of the labor protection and safety system during work.

- workplaces organized according to working conditions;

- The presence of a minimum material and technical equipment on the right of ownership (economic management or operational management) and (or) lease, including a minimum set of equipment, instrumentation, machines and mechanisms that are installed in accordance with the technical requirements for the implementation of construction and installation work, depending on the technical requirements for the declared work of the subspecies of the licensed type of activity;

- A licensee’s work experience of at least five years, while work experience is calculated from the date of obtaining a license or other equivalent permit for foreign persons to carry out construction and installation works, or work experience of at least five years as a category III licensee, while in case of termination of the license, the work experience is canceled;

- The presence of at least five completed construction objects of the second technically simple and (or) third level of responsibility as a general contractor with the submission of documentary evidence (copies of signed acts of putting the facility into operation), or the presence of at least ten objects of the first and (or) second levels of responsibility at which the licensee has implemented work under subcontracts, with the submission of documentary evidence (copies of signed acts of work performed).

To obtain a license for construction and installation works of category I:

- The presence of at least one certified engineering and technical worker in the staff, who has the appropriate certificate for the profile of work included in the requested subspecies of the licensed type of activity and works on a permanent basis with the applicant;

- The presence of a production base on the basis of ownership (economic management or operational management), equipped with:

- administrative and industrial buildings or premises necessary for the performance of the declared types of work, a subspecies of the licensed type of activity. At the same time, administrative, production and other buildings or premises of the production base can be combined, if this does not contradict the requirements of the labor protection and safety system during work.

- workplaces organized according to working conditions;

- The presence of a minimum material and technical equipment on the right of ownership (economic management or operational management) and (or) lease, including a minimum set of equipment, instrumentation, machines and mechanisms that are installed in accordance with the technical requirements for the implementation of construction and installation work, depending on the technical requirements for the declared work of the subspecies of the licensed type of activity;

- A licensee’s work experience of at least ten years, or at least seven years for a person who carried out construction and installation work for offshore oil and gas projects in the Republic of Kazakhstan, or at least five years of work experience as a category II licensee. Work experience is calculated from the date of obtaining a license, while in case of termination of the license, work experience is canceled;

- The presence of at least ten completed construction objects of the first and (or) second levels of responsibility as a general contractor with the submission of documentary evidence (copies of signed acts of putting the object into operation), or at least twenty objects of the first and (or) second levels of responsibility, where the licensee has implemented work under subcontracts, with the submission of documentary evidence (copies of signed acts of work performed).

The license and (or) annex to the license or a reasoned refusal to issue them shall be issued by the licensor no later than fifteen working days.

If you have read this article and you still have questions, then you can contact the specialists of the KORGAN Law Company who will advise you in detail regarding obtaining a license for construction and installation works, tell you what requirements apply to the production base and office premises, what are the required certified specialists, what special equipment is required, equipment for the declared licensed types of work.

You can contact our specialists by contacting us at our office in Nur-Sultan, Almaty or Karaganda, you can leave a request by phone 8 701 7058248 (whatsapp), 8 7172 779705, 8 7212 360605.

Opening of the office of the law firm KORGAN in Almaty

Dear clients, we are pleased to announce that KORGAN Law Company is expanding the territory of its activities and has opened an office in Almaty.

The main activities of our company remain:

1. Representation of interests in court – participation in court on corporate and economic disputes, challenging the actions of state bodies and officials, challenging notifications of tax authorities, challenging illegal inspections conducted by state bodies.

Defense in court in complex categories of civil cases.

2. Registration of individual entrepreneurs and legal entities.

3. Re-registration of legal entities (change of participants, change of name, decrease in authorized capital, change of director, change of address, change of OKED, increase in authorized capital).

4. Obtaining an IIN (individual identification number) for foreign citizens.

Obtaining a BIN (Business Identification Number) for a foreign legal entity.

Obtaining C3, C5 visas for foreign citizens.

5. Licensing of activities: for the implementation of construction and installation works, for the implementation of design activities, for the conduct of survey work, for the implementation of medical activities and other types of activities subject to licensing.

6. Legal support for the activities of small businesses (legal outsourcing, monthly legal services).

7. Registration of trademarks, protection of a trademark from claims of third parties, assistance in obtaining a franchise and a franchise agreement (a registered trademark is a guarantee of protection of your trademark).

We have been steadily moving towards opening an office in the city of Almaty, our many years of experience in the cities of Karaganda and Nur-Sultan (Astana) have given us the opportunity to do this, this is evidenced by cooperation with clients who are under the legal protection of the KORGAN Law Company. We are aware of the problems of small businesses in Kazakhstan and are committed to helping small businesses become stronger and legally protected, to protect them from the arbitrariness of the tax authorities and other government bodies.

Contact the law firm KORGAN for reliable legal protection. In Almaty, we are located at 110 Panfilov street, office 202.

Rules for drawing up a document on the absence of a debtor

The legislation of the Republic of Kazakhstan on rehabilitation and bankruptcy provides for the possibility for the tax authorities to apply to the judicial authorities with an application for the liquidation of the debtor without initiating bankruptcy proceedings in cases of indebtedness to the state budget.

Thus, one of the prerequisites for a tax authority to apply to the court for the liquidation of a debtor without initiating bankruptcy proceedings is the impossibility of establishing the location of the debtor, as well as its participants and officials within 6 (six) consecutive months.

However, until recently, there was no form of a document confirming the impossibility of establishing the location of the debtor, as well as its participants and officials for 6 (six) consecutive months, and the Rules for compiling such a document.

On April 21, 2020, the Order of the First Deputy Prime Minister of the Republic of Kazakhstan – Minister of Finance of the Republic of Kazakhstan dated April 21, 2020 No. 406 “On approval of the Rules for the preparation and form of a document confirming the impossibility of establishing the location of the debtor, as well as its founders (participants) and officials” for six consecutive months.

So, in accordance with the above rules, in the event that all measures and methods are taken to collect tax debts, as well as debts on customs payments, special, anti-dumping, countervailing duties, interest in relation to a legal entity recognized as inactive in accordance with the Code “On Taxes and other obligatory payments to the budget”, an official of the territorial tax authority provides a visit to the location of the debtor, as well as its founders (participants) and officials, indicated in the registration data of information systems of state revenue bodies. When establishing the actual absence at the location of these persons, a second visit is carried out after 6 months.

Based on the results of a visit by an official of a territorial tax authority, a document is drawn up, in the presence of two or more witnesses, confirming the impossibility of establishing the location of the debtor, as well as its participants and officials within 6 consecutive months, which is one of the grounds for applying to the tax court body with a statement on the liquidation of the debtor without initiating bankruptcy proceedings.

Summing up the above, we conclude that the approval of the form of the document and the rules for compiling a document confirming the impossibility of establishing the location of the debtor, as well as its founders (participants) and officials within 6 consecutive months will allow the tax authorities to apply to the institution of liquidation of the debtor without initiating bankruptcy procedures, and the forced termination of the enterprise’s activities will undoubtedly lead to the cessation of the accumulation of debt obligations of the enterprise, as well as to a decrease in the share of unscrupulous entrepreneurial activity, which is fraught with a violation of the rights of both the state, business entities, and ordinary citizens.

The decision of the court of first instance was canceled

Article 9 of the Civil Code of the Republic of Kazakhstan establishes the right to protection of civil rights by the court.

Participants in commodity-money relations are periodically forced to apply to the judiciary for the protection of their rights and legitimate interests.

So, in order to apply to the judiciary for the protection of their rights and legitimate interests, civil procedural legislation regulates the procedural order that everyone who applies to the judiciary for protection must follow.

One of the procedural requirements is the observance of pre-trial or out-of-court procedures.

The pre-trial procedure for resolving a dispute is the presentation of written claims before applying to the judicial authorities. The pre-trial procedure may be regulated by the Agreement or separate norms of the current legislation (for example, under the Bank Loan Agreement).

Out-of-court settlement of a dispute is an appeal to a private notary in order to make an executive inscription. An extrajudicial procedure is possible if there is a documented, indisputable claim from the creditor (collector) to the debtor (debtor), including the debtor’s (debtor’s) response to the creditor’s (collector’s) claim for recognition of claims.

Thus, LLP “K” applied to the judicial authority with property claims against LLP “S” and Citizen “G” for the joint and several recovery of the amount of debt and the amount of the penalty. The statement of claim filed by LLP “K” was accompanied by a letter on recognition of the amount of the principal debt of Citizen “G”.

By the decision of the judicial authority, the statement of claim of LLP “K” was returned due to non-compliance with the out-of-court settlement of the dispute (letter on recognition of the amount of the principal debt of Citizen “G”).

Disagreeing with the Determination of the judicial authority, LLP “K” filed a private complaint with a higher court (appellate instance), with a request to cancel the Determination of the court of first instance and transfer the case for a new trial. In substantiating the arguments that served as the basis for the cancellation of the Ruling of the court of first instance, LLP “K” in a private complaint indicated that, firstly, between the parties, the pre-trial procedure for resolving the dispute was regulated, which, in turn, LLP “K” exhausted by presenting LLP “S ” and Citizen “G” of written claims for payment of the amount of debt and the amount of the penalty, however, the claims of LLP “K” were left unanswered.

Also, LLP “K” in a private complaint indicated that an out-of-court settlement of the dispute in this case is impossible due to the fact that there is a controversial claim, that is, a claim for the recovery of a penalty, with which neither LLP “S” nor Citizen “G” Agree, the answers to the recognition of the amount of the penalty did not provide.

The Court of Appeal, agreeing with the arguments of the private LLP “K”, canceled the ruling of the court of first instance, and remanded the case for a new trial.

In summary, judicial practice shows that if there is one of the requirements that is disputable, an out-of-court settlement of the dispute is not necessary and you have the right to apply to the judicial authority for the protection of your rights and legitimate interests.

The article was prepared by Matsura D.L., Senior Associate at KORGAN Law Company, who took an active part in the civil case to cancel the said court ruling.

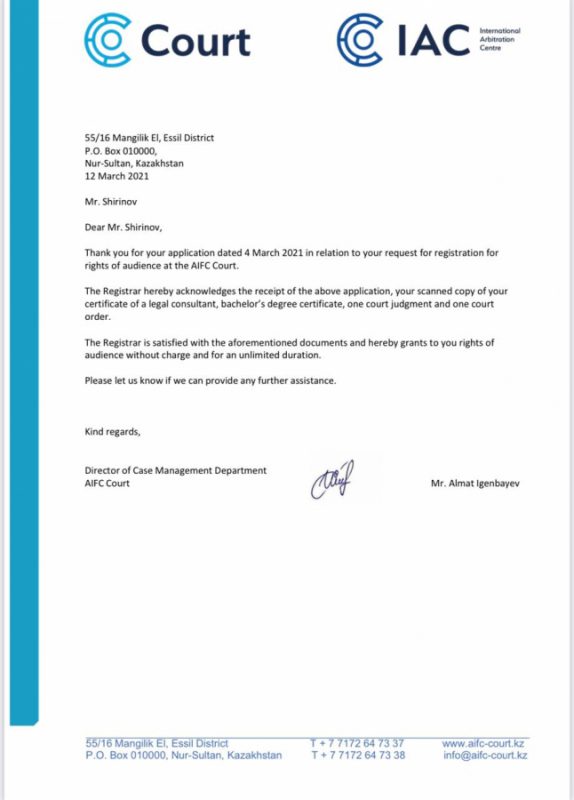

Registration in the office of the Court of the Astana International Financial Center

Lawyers of the law firm KORGAN Alibaev Marat and Shirinov Emin successfully registered with the Court of the Astana International Financial Center (AIFC) and received the right to act in the AIFC Court in order to represent the interests of clients in resolving civil and commercial disputes.

The AIFC Court represents a judicial system based on the rules and principles of the law of England and Wales. It operates in accordance with the best international standards for resolving civil and commercial disputes. The AIFC Court is independent in its activities and is not part of the judicial system of the Republic of Kazakhstan.

The AIFC Court has exclusive jurisdiction to hear cases and make judgments on:

- any disputes arising between AIFC participants, AIFC bodies and/or their foreign employees;

- any disputes relating to any transactions carried out in the AIFC and subject to the law of the AIFC;

- any dispute referred to the AIFC Court by agreement of the parties.

Requisites for payment of state duty to the court in foreign currency

Details of the National Bank of the Republic of Kazakhstan for crediting money in foreign currency to the current accounts of the Treasury Committee of the Ministry of Finance of the Republic of Kazakhstan:

Name of the Bank: National Bank of the Republic of Kazakhstan

SWIFT code: NBRKKZKX

Account number:

USD – KZ91125USD2015300142

RUR – KZ21125RUB2010300142

EUR – KZ81125EUR2006300142

GBP – KZ51125GBP2007300142

CHF – KZ47125CHF2003300142

JPY – KZ03125JPY2016300142

Intermediary banks

| Currency | SWIFT code | Correspondent bank name | Account number |

|---|---|---|---|

|

Over USD 500,000.00

|

FRNYUS33 |

Federal Reserve Bank of New York, NY |

021087219 |

|

Less than USD 500,000.00

|

BKTRUS33 |

Deutshe Bank Trust Company Americas New York, NY |

04098631 |

|

EUR |

DEUTDEFF |

Deutsche Bank AG, Frankfurt am Main

|

10094987750000

|

|

GBR

|

BKENGB2L |

Bank of England, London |

IBAN “GB67BKEN10000041770005”

|

|

CHF

|

UBSWCHZH80A |

UBS AG, Zurich |

02300000069095050000Y |

|

JPY

|

BOTKJPJT |

Bank of Tokyo-Mitsubishi, Ltd.,Tokyo

|

653-0416290 |

|

RUB

|

SABRRUMM 012 BIC 044525225 Correspondent account 30101810400000000225 TIN 7707083893 |

JSC Sberbank of Russia |

30111810500000000124 |

Liquidation of the LLP of the debtor by the tax authorities

The legislation of the Republic of Kazakhstan on rehabilitation and bankruptcy provides for the possibility for the tax authorities to apply to the judicial authorities with an application for the liquidation of the debtor without initiating bankruptcy proceedings in cases of indebtedness to the state budget.

Thus, one of the prerequisites for a tax authority to apply to the court for the liquidation of a debtor without initiating bankruptcy proceedings is the impossibility of establishing the location of the debtor, as well as its participants and officials within 6 (six) consecutive months.

However, until recently, there was no form of a document confirming the impossibility of establishing the location of the debtor, as well as its participants and officials for 6 (six) consecutive months, and the Rules for compiling such a document.

On April 21, 2020, the Order of the First Deputy Prime Minister of the Republic of Kazakhstan – Minister of Finance of the Republic of Kazakhstan dated April 21, 2020 No. 406 “On approval of the Rules for the preparation and form of a document confirming the impossibility of establishing the location of the debtor, as well as its founders (participants) and officials” for six consecutive months.

So, in accordance with the above rules, in the event that all measures and methods are taken to collect tax debts, as well as debts on customs payments, special, anti-dumping, countervailing duties, interest in relation to a legal entity recognized as inactive in accordance with the Code “On Taxes and other obligatory payments to the budget”, an official of the territorial tax authority provides a visit to the location of the debtor, as well as its founders (participants) and officials, indicated in the registration data of information systems of state revenue bodies. When establishing the actual absence at the location of these persons, a second visit is carried out after 6 months.

Based on the results of a visit by an official of a territorial tax authority, a document is drawn up, in the presence of two or more witnesses, confirming the impossibility of establishing the location of the debtor, as well as its participants and officials within 6 consecutive months, which is one of the grounds for applying to the tax court body with a statement on the liquidation of the debtor without initiating bankruptcy proceedings.

Summing up the foregoing, we conclude that the approval of the form of the document and the rules for compiling a document confirming the impossibility of establishing the location of the debtor, as well as its founders (participants) and officials within 6 consecutive months will allow the tax authorities to more and more often apply to the institution liquidation of the debtor without initiating bankruptcy proceedings, and the forced termination of the enterprise’s activities will undoubtedly lead to the cessation of the accumulation of debt obligations of the enterprise, as well as to a decrease in the share of unscrupulous entrepreneurial activity, which is fraught with a violation of the rights of both the state, business entities, and ordinary citizens.

Active participation in the course of the election campaign of the Nur-Otan party

The representative of the law firm KORGAN – senior lawyer Dmitry Matsura took an active part in the election campaign of the Nur-Otan party in the recent elections to the Mazhilis of the Parliament of the Republic of Kazakhstan and maslikhats.

The work of our lawyer was appreciated by the Nur-Otan party and a letter of thanks signed by Elbasy Nazarbayev N.A. was presented.

In a solemn atmosphere, a letter of thanks was presented by Badina Yulia Viktorovna – First Deputy Chairman of the Karaganda City Branch of the Nur-Otan Party.